Inventory Turns

Your pharmacy’s turn rate is a measurement of inventory efficiency. This ratio indicates how often over a period of time, your pharmacy’s inventory is “turned over” to meet dispensing demand. On average, US pharmacies turn their inventories 12x per year.

The formula to calculate your pharmacy’s turn rate is as follows:

(Total cost of goods sold (COGS) over a set period of time) divided by (the average dollar value of inventory maintained over the same time period) Here is an example: ($3,600,000 COGS) divided by ($300,000 on average of inventory) = 12 turns per year

The best way to improve your pharmacy’s turn rate is to reduce its overstock and dead inventory. With the right inventory stock levels, the average dollar value of inventory will go down and as a result, will lead to improved turn rates.

Profit and Loss

Implementing a good inventory management system can reduce many inventory-related expenses – carry costs, replenishment costs, and expired drug return costs.

Your pharmacy’s carry costs are the cost of maintaining a pharmacy’s inventory for the entire year. It accounts for all expenses incurred while maintaining stocked inventory in a pharmacy. Carrying costs include the interest expense on money to purchase inventory (opportunity costs), shrink, the state insurance and taxes on inventory (if applicable by state), and general inventory handling and cycle counting activities.

Your pharmacy’s replenishment costs are comprised of the value/cost relating to the time pharmacy staff spends finalizing and placing orders, confirming receipt of orders, verifying receipt matches the invoice, stock put-away, and processing payments.

It is important to remember is that when these expenses are reduced, your pharmacy will experience stronger profitability and a healthier bottom line.

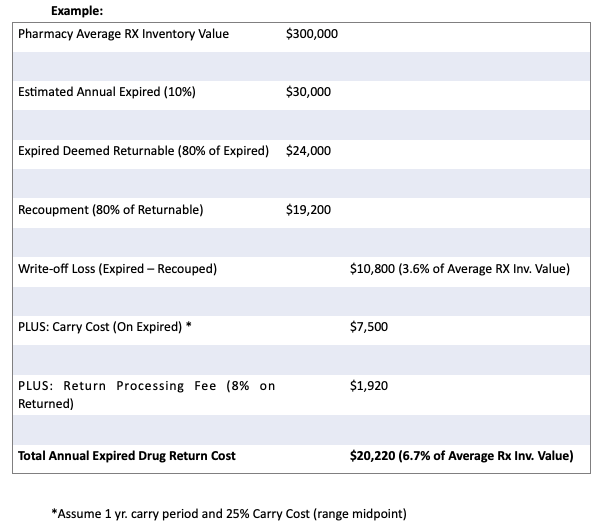

What Are The Costs Associated With Expired Drug Returns?

Your pharmacy’s expired drug returns include all costs associated with purchasing, carrying, and returning unused short-dated and expired inventories.

- Write-off loss – the difference between the acquisition cost and the return credit value received from the manufacturer (via the Returns company).

- Carry costs – According to a study by NCPA indicated that carry costs could range from 20% to 30% annually. It is expressed as a percentage and can be calculated with the following formula: Average inventory value x Carry Cost %

- Return Processing Fees (to Returns company) – these vary but a widely accepted midpoint is 8% of the returned value

- About 80% of the expired value is deemed returnable

- Pharmacies will recoup approximately 80% of returnable inventory

As you can see, the cost of expired returns is substantial. Therefore, efforts to reduce this heavy financial burden can improve profitability and cash flow. See Cash Outflows – below.

What is Cash Flow

Explaining Cash Flow (or CF) can be complicated because, actually CF is a compilation of 3 different components: Cash Flows from Operations, Cash Flows from Investing and Cash Flows from Financing. The combination of these 3 components is provided in financial statements as the “Statement of Cash Flows” or “Cash Flow Statement”.

Simply put, Cash Flow is the generation of cash (cash inflows) offset by the use or consumption of cash (cash outflows). Cash flow is the key to business survival. Generating Net Income does not always indicate positive Cash Flow because if sales are done with a credit (insurance claim receivables) and collections are slow, while a profit may be realized in financial statements for scripts filled, cash inflow does not occur until claims are received.

Cash Inflows:

- Net Income (before non-cash expenses)

- Collection/receipt of Accounts Receivable (insurance claims receivable)

- Reduction of inventory levels

- Increase in Accounts Payable

- Sale of property & equipment

- Increased borrowing

- Net losses

- Expired Drug Return Costs

- Increased Accounts Receivable

- Increased inventory levels

- Reduction of Accounts Payable

- Purchases of property and equipment

- Debt reduction

- Dividends

Effect Of Inventory Management On Cash Flow:

Poor inventory management can quickly lead to bloated, slow-moving, and dead stock as well as excessive levels of expired drug returns. This means pharmacies carrying too much inventory (Cash Outflow) can cripple their Cash Flows. Conversely, poor inventory management can result in carrying insufficient inventory to meet demand which can result in the loss of business and, potentially, the loss of future business when customers buy elsewhere.

It is imperative that you know which items are in surplus in your pharmacy and identify wholesaler returns and get that surplus off your shelves. These recommendations allow pharmacies to eliminate surpluses and convert cash on the shelf to cash in the bank boosting their bottom line and cash position.

How Proper Inventory Management Improves Cash Flow:

Carrying the right inventories at the right levels means that a pharmacy can cover demand without overstocking. Reduction of overstocked inventories reduces cash investment levels (Cash Inflow) and, ultimately, reduces future dead stock levels and expired return volumes and all the unfortunate expenses associated (see Expired Drug Returns – above).

Strong inventory management can reduce Cash Outflow and improve overall cash flows. Remember, Rx inventories represent the largest investment and biggest expense for pharmacies … the better it’s managed, the more Profit and Cash Flow a pharmacy will enjoy. Datarithm®’s cloud-based software is the perfect solution to improve RX inventory management and drive your pharmacy’s cash flow. Click here to learn more.